Concerns surrounding the ongoing coronavirus outbreak in China have dominated the headlines in financial markets in the past few weeks.

An estimated 3 billion trips usually take place during the Chinese New Year holiday season, making it the busiest period of mass human migration at any point during the calendar year. There is now no doubt that concerns surrounding the outbreak of the virus will have warned off foreign visitors, halted domestic business-related travel and prevented the movement of goods. Transport providers, retail outlets and hotels are among those that are set to be the worst affected by the epidemic, while international supply chains are likely to be disturbed – a concerning development considering China’s critical role in global trade.

The negative impact on Chinese business activity is, however, likely to be less severe than it would have otherwise have been, given that factories and businesses across the country were already set to close during Chinese NY – the majority between two to four weeks. While concerns surrounding the virus were not evident during the entirety of the month, Caixin’s manufacturing PMI for January actually held up relatively well and remained above the level of 50 that denotes expansion. That being said, we still think that it is now not a matter of whether or not the Chinese economy will take a hit from the coronavirus outbreak, but to what extent. Rating agency S&P is one of the many to have slashed its growth forecast for China in the past few days, lowering its 2020 growth estimate to just 5% year-on-year from its previous 5.7% estimate.

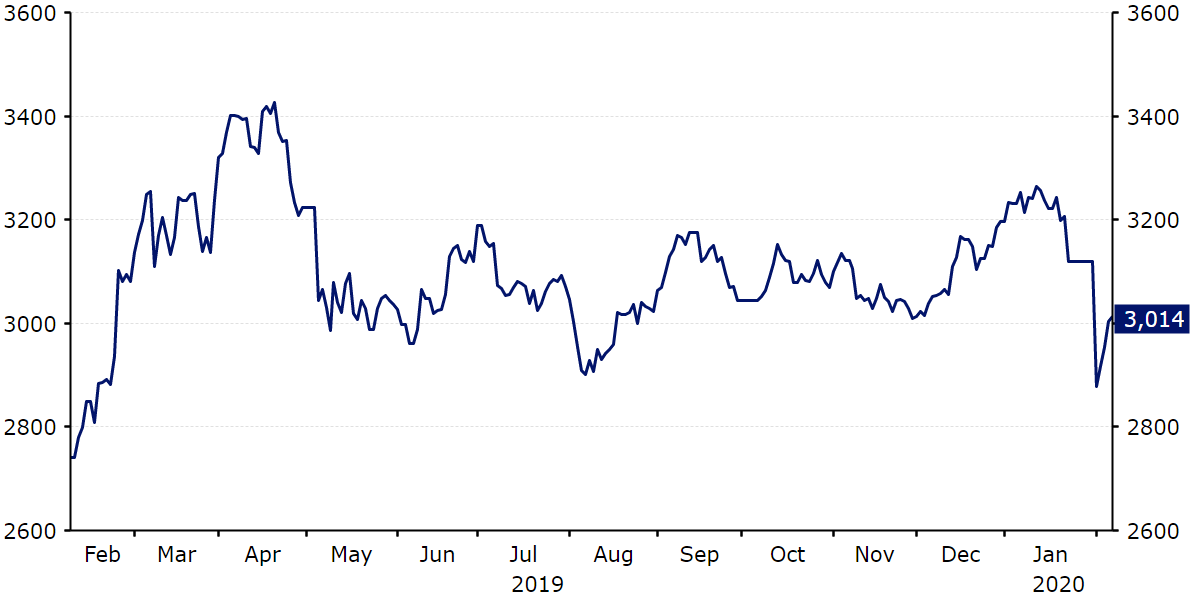

As far as how the markets have reacted, equities sold-off sharply as investors dumped higher risk investments in favour of lower-risk government bonds. China’s Shanghai Composite index suffered its largest drop in four years when markets reopened after the Lunar New Year holiday, closing the first trading session back around 8% lower than where it began it (Figure 1).

Figure 1: Shanghai Composite Index (February ‘19 – February ‘20)

In the foreign exchange market, investors have reacted as one would expect, flocking to the safe-havens and selling the currencies whose economies rely most heavily on demand from China. The Japanese yen, as it usually does during times of investor uncertainty or financial market stress, has been the main beneficiary, rallying by 1.5% in the second half of January to around the 108 mark versus the US dollar., Unsurprisingly, the Chinese yuan sold-off fairly aggressively, falling back below the psychological 7 level to the USD, with a number of other emerging market currencies, particularly those in Asia, dragged down with it. Crude oil prices have also fallen sharply, almost 20% since the beginning of the year, reflecting China’s importance to the overall global demand of the commodity. This has led to a depreciation in many of the oil-dependent currencies such as the Canadian dollar and Norwegian krone. The currencies of those countries that are heavily dependent on external demand from China, such as the Australian dollar, have also been affected.

That being said, the FX market has remained remarkably steady for the most part. We have actually begun to see an unwinding of some of the aforementioned currency moves in the past few days, including a rebound in CNY to roughly where it began the year and an unwinding in safe-haven flows. Equity markets have also rebounded. The S&P 500 and Dow Jones indexes are now back trading higher year-to-date, while the Shanghai Composite index has at least stabilised following its sell-off. This suggests that concerns surrounding the potential economic impact of the virus are abating.

Investors have been calmed somewhat by the fact that the virus has so far remained mostly contained within China. Of the 43,129 confirmed cases of coronavirus (as of 09:53 GMT on 11/02/20), 42,658 (98.9%) have been reported within mainland China, with only two deaths reported outside of the border (0.2% of the total fatalities). The vast majority of both the total confirmed cases and deaths (73.6% and 95.7% respectively) have also been reported exclusively within the Hubei province, where it is said to have originated, with newly reported cases appearing to stabilise. Creating a logarithmic chart of both the number of confirmed coronavirus cases and deaths caused by the virus (Figure 3), which removes the exponential nature of the early spreading, we can see that the rate of transmission appears to be easing.

Figure 3: Coronavirus Confirmed Cases & Deaths [log scale] (21/01/20 – 10/02/20)

, Moreover, the majority of the deaths, approximately 80%, have been contained to those over the age of 60, with 75% of the deaths among those with pre-existing health conditions. It is also worth noting that the recovery rate of the virus has improved markedly, with the ratio of those totally recovered to deceased now standing at around 4.15:1 (and rising) versus less than 1:1 at the end of January.

What could happen next?

We believe that the reaction of the market in the short-term now rests greatly on the Chinese government’s ability to contain the virus, particularly the length of time that travel restrictions remain in place. Should the spread of the virus become more aggressive and the number of those confirmed cases outside of China begin to rise, then we would expect a recommencing of the trends witnessed at the virus’ outbreak. This would, we believe, involve a renewed flock to the safe-havens, chiefly the Japanese yen, and another sell-off in risk assets, particularly Chinese equity markets and the yuan.

In the longer run, we think that much will depend on the severity of the economic impact. Should it become clear in the coming weeks that the virus is having a bigger-than-expected negative impact on the Chinese economy then we may see risk assets back under pressure again. We will be paying particularly close attention to the upcoming retail sales numbers (14/02) and the official NBS PMIs (29/02) for any signs of a slowdown there. But for now, the market is in a much calmer mood than it was a week or two ago and central bankers around the world are not jumping to ease monetary policy just yet. The People’s Bank of China has already taken steps to allay the potential downside impact of the virus, cutting its seven-day reverse repo rate by 10 basis points to 2.4% and injecting the equivalent of $175 billion of liquidity into the banking sector, which is an encouraging development.

As things stand we are optimistic that the worst of the market reaction is behind us. We think that we could see a repeat of the SARS virus, in which we see a lot of negative headlines, but no lasting long-term impact on financial markets or damage to the global economy. Stocks worldwide have rebounded, including in China, emerging market currencies have stabilised, while the USD/JPY cross is now trading higher year-to-date on signs that the virus is not spreading further afield. Calls for a sharp slowdown in Chinese growth to 5% year-on-year in 2020 are also too aggressive, in our view. We think that the negative economic repercussions are likely to prove temporary, with domestic activity to pick-up steam once the virus abates, which will hopefully be sooner rather than later.

*as of 11/02/2020