🎙️ FX Talk | Get updated on what's happening on the financial markets in 20 min. listen here.

-

AU

-

Australia - English

- België - Nederlands

- Belgique - Français

- Canada - English

- Česká Republika - Čeština

- Deutschland - Deutsch

- España - Español

- France - Français

- Ελλάδα - Ελληνικά

- Hong Kong - English

- Italia - Italiano

- Luxembourg - English

- Nederland - Nederlands

- Polska - Polski

- Portugal - Português

- România - Română

- Schweiz - Deutsch

- Suisse - Français

- United Arab Emirates - English

- United Kingdom - English

- Hong Kong-Traditional Chinese

-

Australia - English

Ebury London

100 Victoria Street

London

SW1E 5JL

+44 (0) 20 3872 6670

[email protected]

Ebury.com

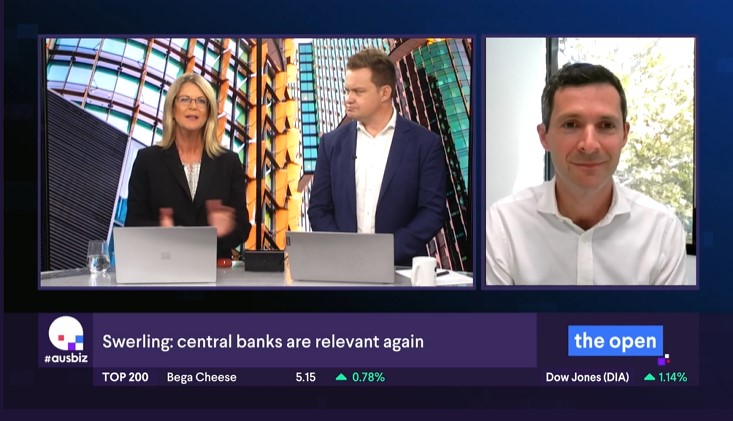

FX view: central banks are relevant again

- Go back to blog home

- Latest

1 February 2022

James Swerling from Ebury gets straight to the point – central banks are relevant again.

It’s the first time since 2018 that higher rates are coming, and the first time since the mid-2000’s that the RBA and the Federal Reserve are hiking simultaneously. He’s getting set for more sustained periods of volatility in the FX markets compared with the last five years. James points out that typical FX moves a couple of years ago were 0.4% per day with 1% moves rare, and now January has been peppered with 1% or more.

In a contrarian view, he expects the USD to weaken from early March when it embarks on its rate hike cycle. Proof? In the first 100 days of the five big tightening cycles of the past 35 years, the big dollar has actually weakened. We also chat about the outlook for the yen – is it still a hedge against volatility, and finally what is relative value when comparing the outlook for the Australian and New Zealand dollars.

Watch the full interview here

Cookies and Privacy

This site uses cookies to ensure you get the best experience. For more information see our Privacy NoticeAccept Settings Reject

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _ga_DGRPXRE06R | 2 years | This cookie is installed by Google Analytics. |

| _gat_gtag_UA_51187572_49 | 1 minute | This cookie is set by Google and is used to distinguish users. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| CONSENT | 16 years 4 months | These cookies are set via embedded youtube-videos. They register anonymous statistical data on for example how many times the video is displayed and what settings are used for playback.No sensitive data is collected unless you log in to your google account, in that case your choices are linked with your account, for example if you click “like” on a video. |

| pardot | past | The cookie is set when the visitor is logged in as a Pardot user. |

| Cookie | Duration | Description |

|---|---|---|

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| yt-remote-connected-devices | never | These cookies are set via embedded youtube-videos. |

| yt-remote-device-id | never | These cookies are set via embedded youtube-videos. |

| Cookie | Duration | Description |

|---|---|---|

| _lfa | 2 years | This cookie is set by the provider Leadfeeder. This cookie is used for identifying the IP address of devices visiting the website. The cookie collects information such as IP addresses, time spent on website and page requests for the visits.This collected information is used for retargeting of multiple users routing from the same IP address. |