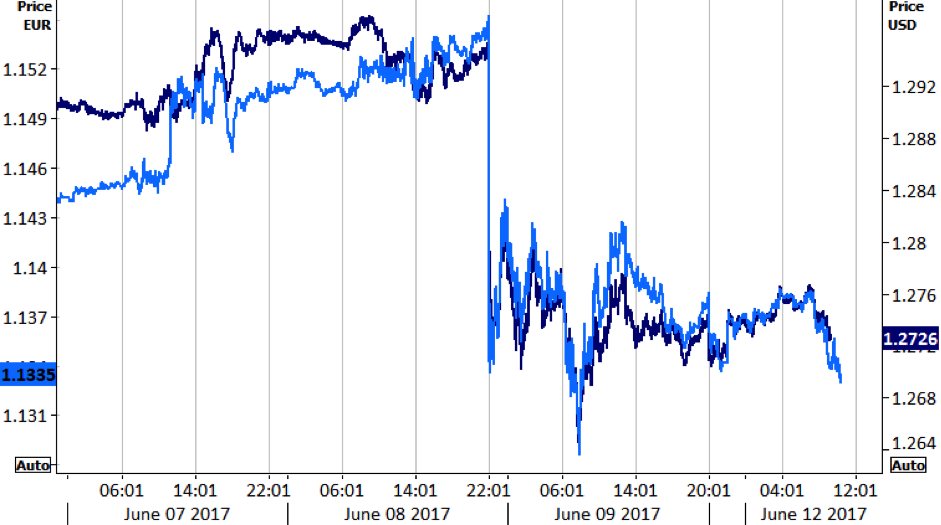

Figure 1: GBP/USD & GBP/EUR (12/06/2017)

Last week’s star was without doubt the Mexican Peso. It got an early boost as the Government eked out a narrow win in a key regional election, and it continued to rally throughout the week as markets took the view that a seriously weakened Trump administration will be unable to effect any significant restrictions to US-Mexican trade.

This week’s focus shifts to the Federal Reserve’s June meeting. The Fed is universally expected to hike rates, but its communications will be scrutinised to ascertain the likelihood of one or two more hikes before year end. Other central banks also meet this week including the Bank of Japan, the Bank of England and the Swiss National Bank, all of whom are expected to keep their policy largely unchanged.

,

Major currencies in detail

GBP

The general election has undoubtedly thrown the UK Government into turmoil. The Conservatives lost 12 seats and are now well short of a majority. Talks are underway to form a Government with the DUP. Even if an agreement is reached, this Government would have a weaker negotiating hand in the Brexit process and there would always be the chance that a fractious Parliament would manage to kill whatever agreement is reached. An even worse scenario is that a new election has to be called. All the while, the Article 50 two-year clock is ticking away.

Either way, markets are likely to attach a significant risk premium to Sterling. We think that the path of least resistance for the time being is down. We will soon revise our forecasts accordingly. At any rate, we are probably facing a period of market volatility comparable to that of the immediate aftermath of the Brexit referendum.

EUR

All eyes were on the ECB June meeting last week. In the end, the central bank delivered a decidedly mixed message. Its forward guidance removed the reference to the possibility of lower rates, and it declared that the risks to the outlook were now balanced rather than weighted to the downside. However, it significantly lowered its projections for inflation, and made it clear that there would be no tapering of the QE program until inflation seemed certain to reach the ECB’s target. Markets chose to focus on the latter and the Euro retreated modestly from its recent highs against the Dollar, dragging down most of the other European currencies.

Data from the Eurozone is relatively light this week. The common currency will mostly trade in reaction to events elsewhere, notably the Government negotiations in the UK and the crucial Federal Reserve meeting on Wednesday.

USD

In a week when the data calendar was pretty light, markets had built some expectations for volatility around the testimony of former FBI director Comey. There were no major revelations and the US Dollar skated through the event unscathed.

This week is all about the Federal Reserve meeting on Wednesday evening. A hike is all but priced in by markets. The key will be to gauge the likelihood of further hikes this year, based on the “dot plot”, the FOMC’s economic projections, and Chair Yellen’s answers at the press conference after the meeting. Our expectations are for more hawkish communications than the market has priced in, with the Fed leaving the door open for one or two further hikes. If correct, this should provide solid support for the greenback.