Sterling leaps to seven-month high ahead of election

- Go back to blog home

- Latest

Ongoing expectations that the Tory Party will romp home to a comfortable election victory next week continued to support sterling this morning, which was lightning quick out of the traps as London trading opened for the day.

Arguably the main reservation for some investors to not buy the pound has been concerns regarding a repeat of the 2017 election, where the Labour Party dramatically closed the gap in the polls in the week or two leading up to the vote. Given that we have so far not witnessed such a narrowing, the move higher that we’ve witnessed in the pound so far this week is therefore no real surprise.

US dollar index hovers around one-month lows

The US dollar index held firm around its lowest level in a month this morning, under pressure from ongoing trade tensions and some relatively strong China data that has helped buoy risk appetite.

This afternoon is a fairly busy one in terms of macroeconomic data out of the US. First up, we’ll have the ADP employment change number, representing job creation in the US private sector. This generally gives a decent indication as to the strength of the much higher profile nonfarm payrolls report, out on Friday afternoon. We’ll then receive the November non-manufacturing PMI from ISM. Following Monday’s underwhelming manufacturing index, we think that there is scope for this number to surprise to the downside.

Eurozone services PMI ticks upwards

More signs that the Euro Area economy is heading back in the right direction has undoubtedly helped lift the common currency higher this week.

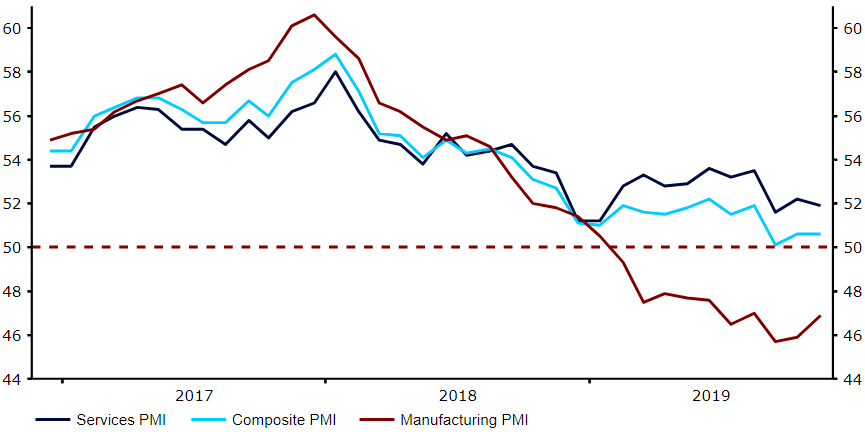

Following on from Monday’s better-than-expected manufacturing data, this morning’s services PMI also beat expectations. The index rose to 51.9 in November from 51.5. These tentative signs of a rebound are highly encouraging and support our view that the European Central Bank is unlikely to consider ramping up its stimulus measures in the short-term.

Figure 1: Eurozone PMIs (2016 – 2019)

Thursday’s revised third quarter growth numbers out of the Eurozone are not expected to rock the boat. The common currency is instead likely to be driven largely by this Friday’s payrolls report out of the US.